Is your retirement ready to S.A.I.L?

Focused on You.

Grounded in Strategy.

Built for What’s Next.

We help successful families reduce risk, minimize taxes, protect income, and retire with confidence — using a personalized process we call S.A.I.L.

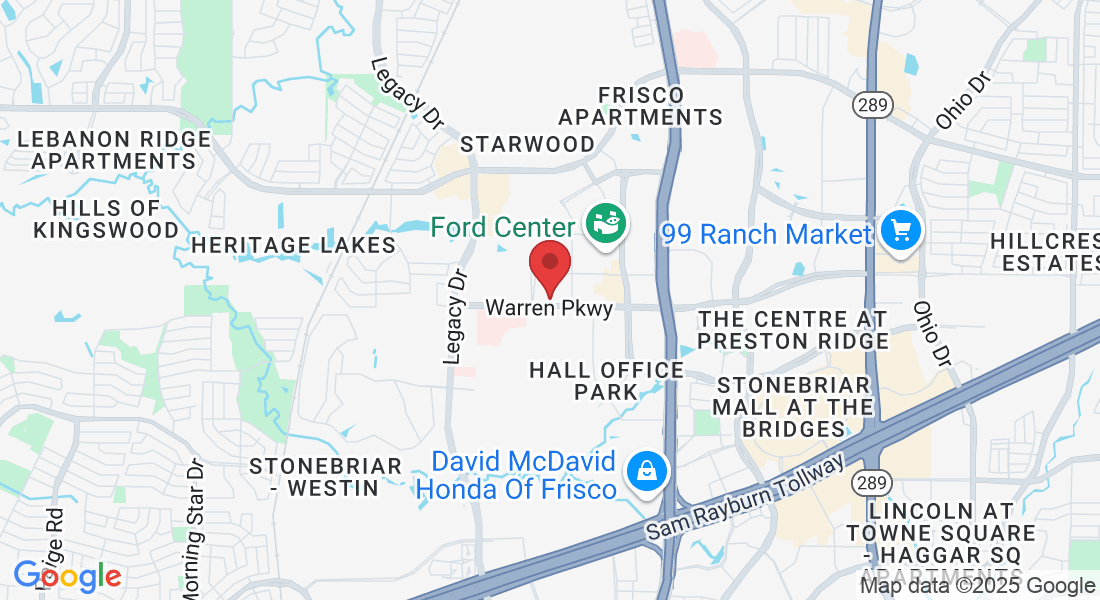

The Compass

Your Direction, your destination

Most retirees are sailing blind — unsure where they're headed or how to get there. The Compass is our deep discovery process. We help you clarify your goals, understand your financial landscape, and determine exactly where you’re going — before we move a single dollar.

The Anchor

Protect what you've built

Your retirement plan shouldn’t drift with the market. The Anchor is our tax and income protection strategy — built to steady your financial future. We use proven tactics like Roth conversions, IRMAA avoidance, and RMD smoothing to keep your plan from capsizing.

The SAIL

Your retirement plan, simplified

Once your direction is clear and your anchor is secure, we implement your complete S.A.I.L. strategy — a step-by-step framework that makes sure nothing gets missed.

Meet Your Team

ERIC G. EDWARDS

President, Author,

FRC, Lead Advisor,

Investment Advisor Representative

SURESH KUMAR

Tax Specialist, CPA, Estate Planning Attorney

LOC PHAM

Servicing Advisor, Executive Assistant, Business Development Director

SAMUEL EDWARDS

Client Support, Administrative Assistant, Processing

Get the book!

Golden Rules To Retire By

by eric g. edwards

The real reason the 4% rule could fail you

Learn how sequence of returns and inflation quietly sabotage static withdrawal plans.

The two bucket rule

The Two-Bucket Rule: A safer way to draw retirement income

Balance growth and liquidity with a dynamic income strategy.

The Rule of 100

How the rule of 100 can help you map out a blueprint for your retirement years.

Why hitting a “magic number” isn’t the key to retiring well

Your net worth means nothing if your income isn’t sustainable and tax-smart.

Why buy-and-hold is dead for retirees

Volatility isn’t your friend anymore—especially when you need consistent income.

What exactly does S.A.I.L mean?

S.A.I.L. is more than a catchy acronym — it’s the foundation of every plan we build.

Most retirees think retirement is about hitting a number. But the truth is:

Retirement is about staying financially steady through decades of economic change, tax law shifts, and unexpected life events.

Our S.A.I.L. Process ensures your plan isn’t just designed to survive — but to thrive.

Breakdown:

S — Secure

“Protect what you can’t afford to lose.”

We help you allocate your assets in a way that aligns with your goals, timeline, and risk tolerance.

This means:

Stress-testing your portfolio for volatility

Reducing unnecessary risk near retirement

Incorporating stable, income-producing assets

A — Anchor

“Your tax-smart foundation.”

Taxes are the #1 silent killer of retirement income.

We use powerful tools like Roth conversions, RMD smoothing, and IRMAA reduction strategies to help:

Minimize taxes now and later

Avoid the widow’s tax penalty

Eliminate Medicare surcharges and bracket creep

This isn’t tax prep. This is tax strategy — and it’s often worth six figures.

I — Income

“Income is the outcome.”

A retirement plan without a year-by-year income strategy is like sailing without a map.

We help you:

Strategically time Social Security

Layer income sources to reduce volatility

Build a withdrawal plan that balances growth, liquidity, and confidence

L — Legacy

“Leave more than money.”

We’ll help you structure your assets to pass on wealth intentionally — with clarity and tax-efficiency.

Ensure beneficiaries are protected

Avoid probate surprises

Transfer wealth in a way that honors your values

Want to see how S.A.I.L. applies to your situation?

Start with a free strategy call — and let’s map out your journey.

----------- Testimonials ------------

Happy Clients

"Eric mapped my retirement income out to be exactly what I told him I wanted. The best part is it happened like he said it would."

Carl Twilley

Current Client

NOT A PAID ENDOREMENT

"The team at SurePath are always there for me.

I have called at odd hours and even on weekends.

Eric even took my call on a Sunday at 10 PM."

Steve Ogden

Current Client

NOT A PAID ENDOREMENT

"My wife and I love the team at SurePath.

I now have peace of mind and enough retirement income

to sleep well at night."

Michael Stoddard

Current Client

NOT A PAID ENDOREMENT

WE PROUDLY CUSTODY AT CHARLES SCHWAB:

Why We Custody with Charles Schwab

At SurePath, we believe retirement should feel secure, simple, and stress-free. That’s why we proudly custody your assets with Charles Schwab, one of the most trusted names in finance.

Strength & Security

Schwab safeguards more than $8 trillion in client assets, serving over 34 million accounts nationwide.

Your assets remain in your name, protected by SIPC coverage.

Independence & Transparency

All statements, trade confirmations, and tax documents come directly from Schwab — not just from us.

This ensures complete clarity, transparency, and peace of mind.

Access & Technology

24/7 online and mobile access to your accounts.

State-of-the-art digital tools designed to keep you in control at every stage of retirement.

Our Commitment

By partnering with Schwab, SurePath aligns your retirement plan with a custodian whose sole mission is to keep your assets safe and accessible. Together, we help ensure that your Golden Rules to Retire By are not only written — but lived.

WE PROUDLY PARTNER WITH BISON WEALTH AS A TAMP OPTION FOR CLIENTS:

Why We Partnered with Bison

We wanted to stay true to our Texas roots as a locally owned and operated Registered Investment Adviser but at the same time we felt our clients deserved more than a local firm could deliver to them, alone.

We chose to partner with Bison, a world-class Turnkey Asset Management Platform (TAMP), because we believe our clients deserve

the same level of planning, protection, and opportunity that billionaires receive. This gives us the power and resources of a ten-billion-dollar family office behind us.

Bison was founded with a vision to help families Plan, Protect, and Prosper—the same core pillars that guide our philosophy. Backed by the Terry and Kim Pegula Family Office (East Asset Management) and co-founded with operating partner Teton Capital Partners, Bison is far more than just another investment platform. It’s the financial infrastructure built by and for elite-level wealth management.

Terry Pegula’s rise from petroleum engineer to billionaire entrepreneur and professional sports team owner brought with it access to the highest tiers of financial strategy and planning. That level of access, insight, and capability is now available to you—through our partnership with Bison.

By integrating Bison’s institutional-grade platform, we’re able to deliver:

Access to best-in-class investment models and institutional money managers

Tax-efficient strategies that adapt as laws and markets change

Streamlined financial technology that simplifies your experience

Family-office level planning capabilities—without the gatekeeping

This isn’t just a platform. It’s a philosophy—one built for resilience, opportunity, and legacy.

OUR INVESTMENT SOLUTIONS INCLUDE:

Call

972-878-8821

Email:

Site:

www.surepathwm.com

SurePath Wealth Management, LLC (“SurePath”) is a Registered Investment Adviser (RIA) based in the state of TEXAS. Registration with the SEC or any state securities authority does not imply a certain level of skill or training.The information provided on this website is for informational and educational purposes only and is not intended as investment, tax, legal, or accounting advice. You should consult your own advisors before making any financial decisions.All investment strategies involve risk, including the potential loss of principal. Past performance is not indicative of future results.SurePath provides personalized investment advisory services only after entering into a written agreement and receiving all required documentation from a prospective client.Any mention of third-party platforms, partnerships (including Bison), or tools does not constitute an endorsement or guarantee by SurePath. Clients should review all associated disclosures and terms independently.